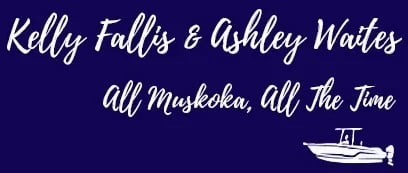

58% of properties that traded on the open market in 2023 were waterfront; not surprising when the District of Muskoka has some 1600 lakes. With a limited supply of inventory trading hands, pricing was up; the average waterfront freehold property in Muskoka in 2023 was $1.737M, up from $1.467M the year prior.

There is no more room on the pond as the saying goes. No matter which waterbody you desire to be on, space is extremely limited, even the biggest of lakes, which is why Muskoka values are holding their own. In addition, bylaws are continually requiring more than less frontage to create new lots so there is never ever going to be a “wave” of opportunity. Limited inventory is and will continue to be the storyline of Muskoka real estate for years to come.

Why do cottages get listed for Sale? Of course during Covid investors saw the light and hoped they could generate a great return on investment but that storyline is already weaning out into 2024. The top reason Muskoka properties come for sale are family dynamics whether it’s aging or family drama as I like to call it. Generally the property has been in the family for decades and the younger generation is not interested or can’t afford to keep the tradition alive, or the parents have come to terms with the fact that their kids/grandkids visit 1-2 weeks a year and its a heck of alot more maintenance as they get older so it would make more sense to sell it and move closer to their kids to see their family more often.

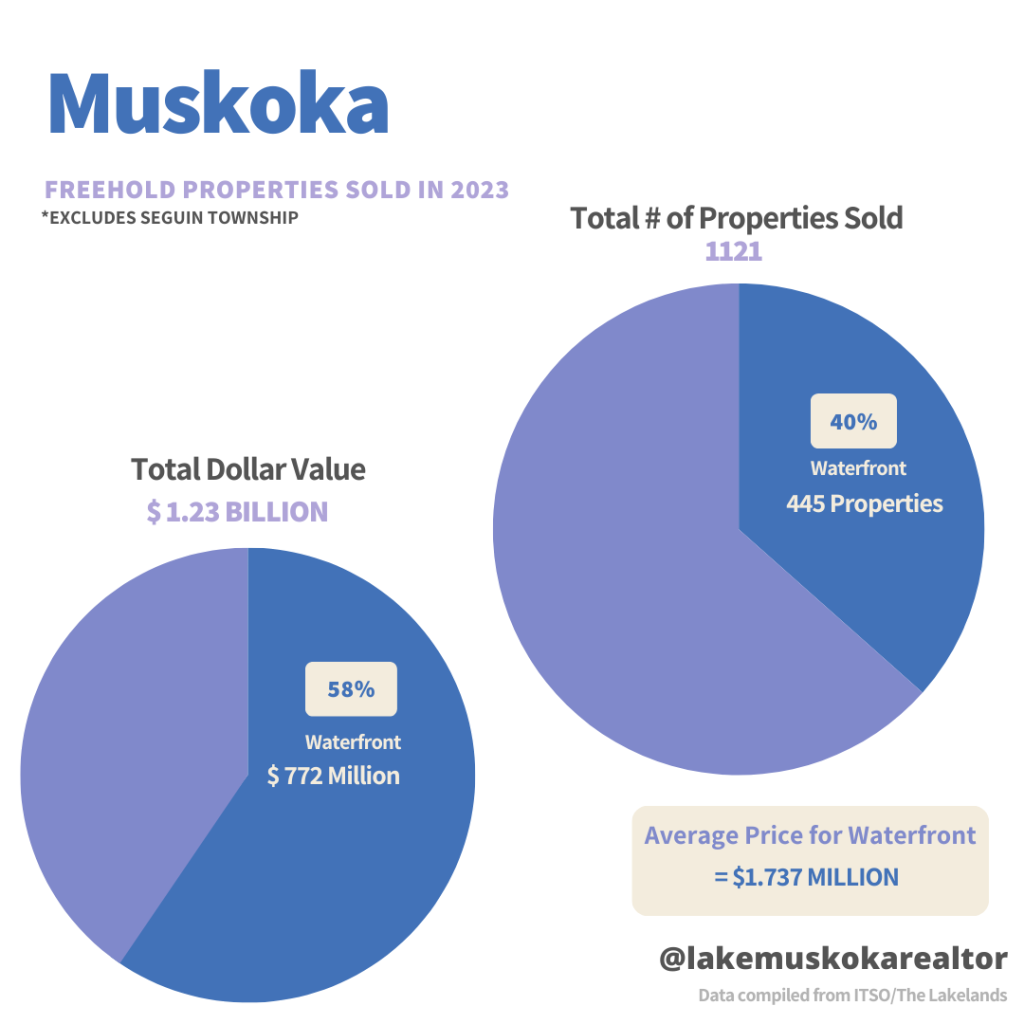

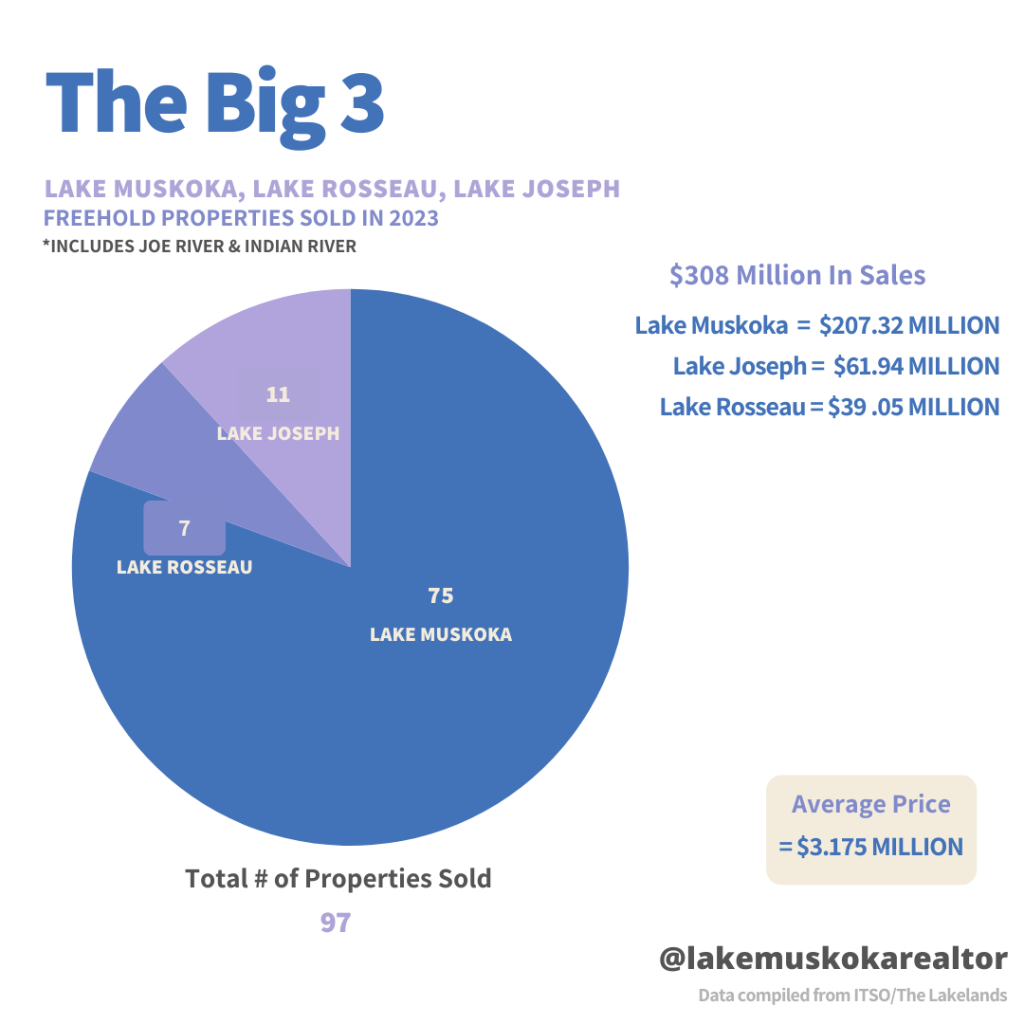

Looking solely at the ‘Big 3’ (Lakes Muskoka, Joseph & Rosseau) there were just 97 sales on the open market in 2023, down from 123 the year prior. However , there were 170 properties listed for sale so that’s only a 50% sell through rate.

Interesting to note there are 7400 odd properties among the ‘Big 3’ lakes, with the vast majority of them being on Lake Muskoka, and 20% of those island properties. That means less than 1% trade hands on the open market each “season” or year. While there are many more lakes this story is now echoed on waterbody throughout Muskoka. Recall, Covid introduced way more eyeballs to the region than one could have ever imagined; Muskoka’s ‘Once Discovered Never Forgotten’ tagline couldn’t be more appropriate and there is no shortage of buyers trying to carve out their Muskoka story. To say there are far more buyers than sellers would be the understatement of the year!

What’s interesting to note on the ‘Big 3’ is prices levelled off from Covid peaks and the average price in 2023 was down some $300k from the year prior to $3.175M. Many a buyer has been sitting on the sidelines waiting for the ‘Big 3’ to cool off, and between that and talk of interest rate cuts as we move through 2024 it’s going to be interesting to see how they react at the offer table. ‘

Here’s what our crystal ball tell us about 2024

There were 599 waterfront sales in Muskoka in 2023, 23 of which sold between Jan 1 – mid February. Over the same time period in 2024 we’ve seen 18 waterfront sales.

The under $1.5M waterfront market segment is going to be a zoo, all thanks to precious little inventory. Interesting to note that the first new sale in 2024 (like actually new/not been for sale last year) was listed under $1M, had 2 offers and sold for slightly under the asking price. It would appear buyers are attempting to be savvy and not run up prices but attempt to achieve good value. Whether that holds true when mass buyer attention returns in the spring market remains to be seen. If you’re in this bracket you absolutely need to have your financing ducks in a row by March so you can manoeuvre quickly once the listings come out. Our call is it’s going to move fast, fast, fast.

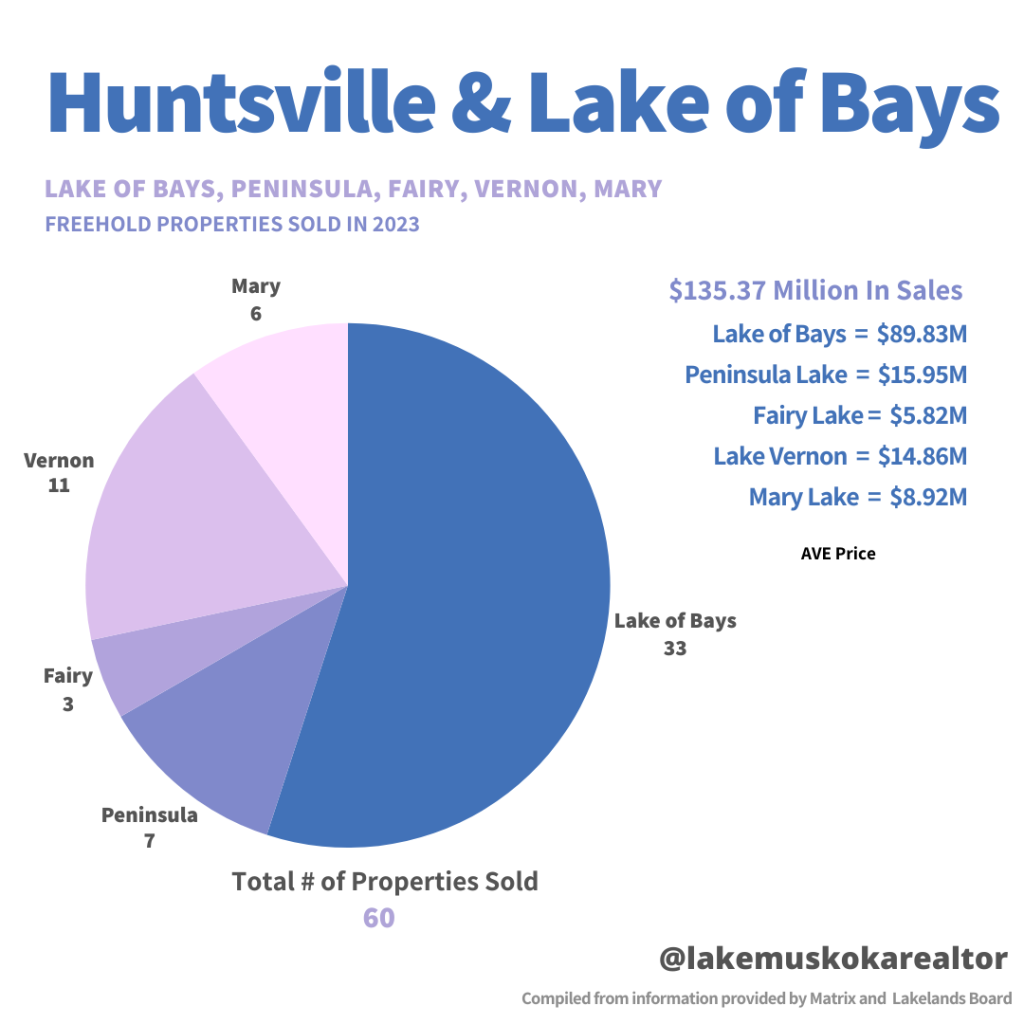

The under $3M waterfront market will likely follow suit, particularly on the ‘Big 3’ as it’s becoming more of a rarity to find properties in this price point on Lakes Muskoka, Rosseau or Joseph. There are some great properties to the north on Lake of Bays, Mary, Fairy, Vernon and Peninsula in this price range; you just have to be willing to commute a little further.

The $3-6M waterfront market is probably the toughest segment out there. There seem to be alot of buyers in this category and most parties in it prefer to be at the south end of Muskoka so focus on the ‘Big 3’ lakes. Worth noting 20% of all ‘Big 3’ 2023 sales were in this price point.

The $6-10M waterfront market surprisingly has more parties than one would imagine. 15% of the 2023 ‘Big 3’ sales were in this price point. As the price point increases the buyers decrease, but the odds that you will be the only party come offer time are slim, especially if it’s a great property.

Worth noting, on the residential non-waterfront side of things all signs are pointing to a more normal year thankfully. Interesting to note in Muskoka off water there were:

- 1102 sales in 2019

- 1331 in 2020

- 1462 in 2021

- 931 in 2022

- 764 in 2023

With sales down 20% in 2023 Year over Year, and 30% from levels they typically saw pre-Covid there is sure to be pent up demand. It’s been so painful to hear stories of people who actually need to /want to move not being able to do so because they can’t find a place to relocate to.

From Jan 1 to mid February 2023 there were 48 sales, and thus far in 2024 for the same time period we’ve seen 70. With interest rate cuts ahead we’re very optimistic the Muskoka residential market will return to a more normal cycle through 2024 and all those who have been patiently been waiting, to upsize or downsize, can finally make a move🤞.