Prime Muskoka waterfront is an anomaly in the world. Interest rates are rising and are higher than they were when money was “free” two years ago, but historically they are still very low. Demand is still strong, while the next few months will be a transitional period for buyers, by March, demand will intensify again.

- Not all of Muskoka is the same and the north/south divide has returned. South Muskoka has always been more desirable because its closer to the GTA. Nothing about that will change, and the Gravenhurst “waterfront market sales” numbers are down 23% as opposed to 53% in Huntsville.

- Muskoka Lakes holds the most expensive real estate with the average waterfront sale price at Q3 2022 being $2.461M. That’s up 29% from Q3 2021

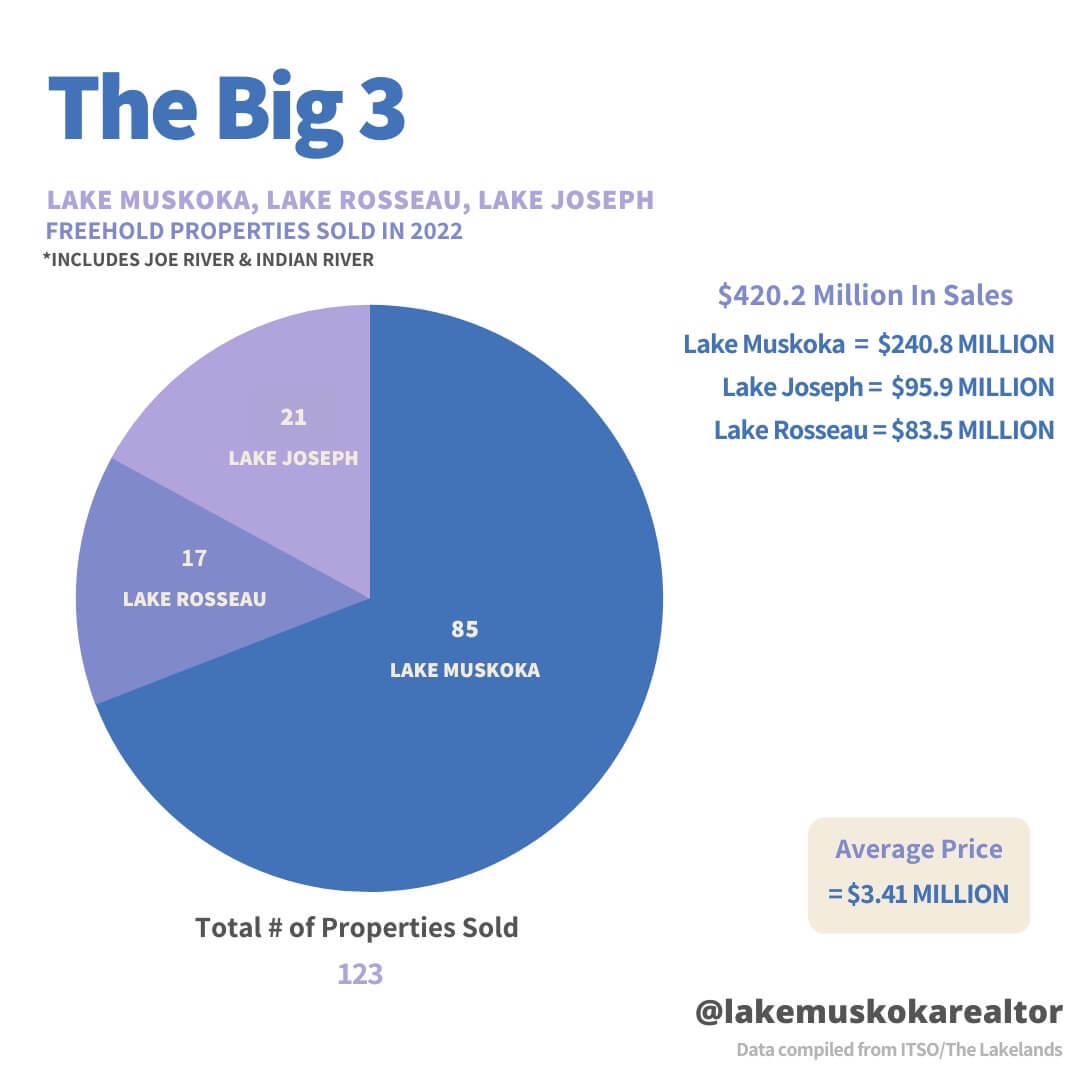

- To the end of Q3 2022 the average sale price for waterfront on the big 3 (Lakes Muskoka, Joe and Rosseau) levelled off $3.75M. That’s up from $2.3M in 2018. Price stability is strong

Key Details:

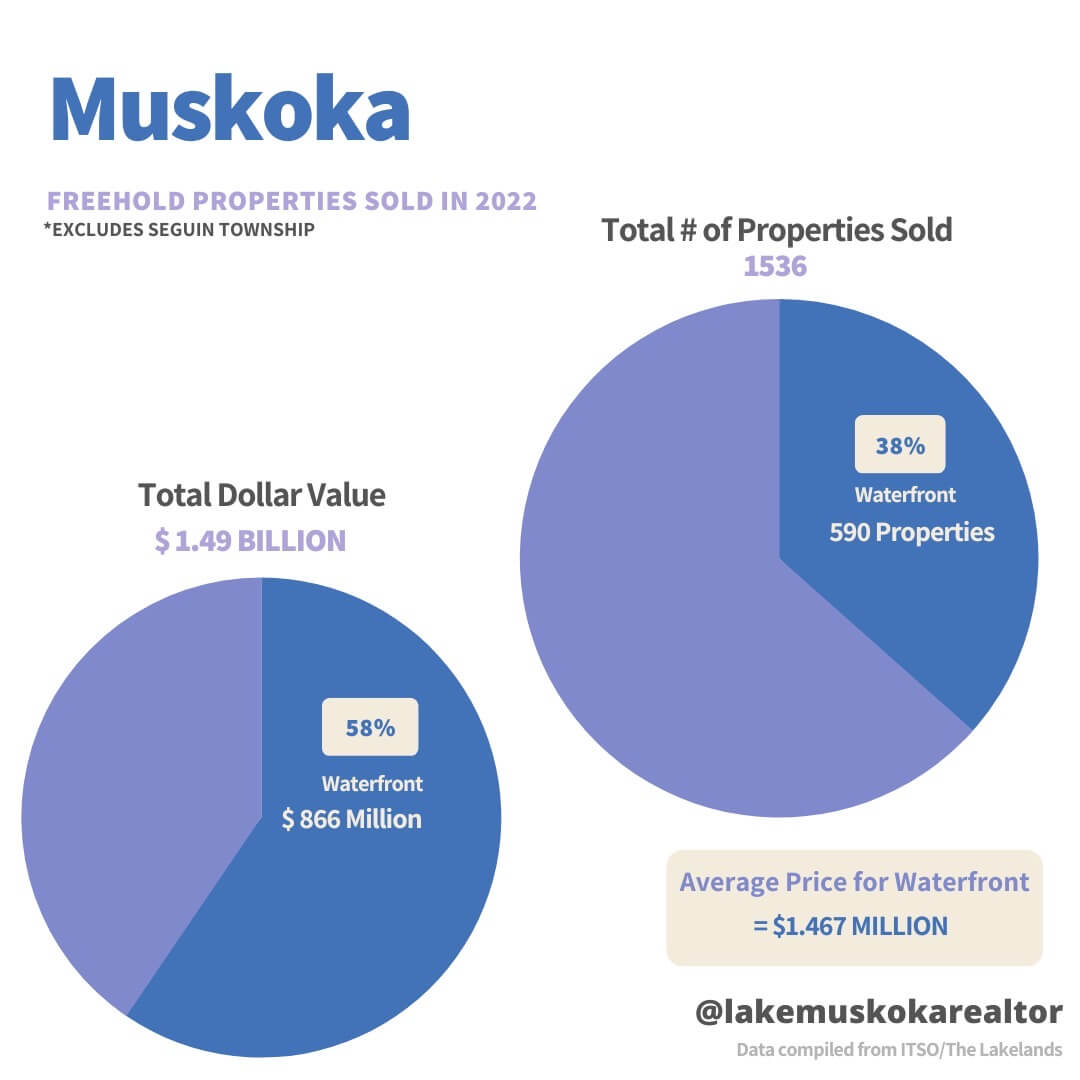

- Just shy of $1.5 billion dollars traded hands in freehold (single family) properties in Muskoka in 2022, of which 58% was waterfront.

- You simply can’t create more waterfront. Of the 590 waterfront properties sold, honing in on the ‘big 3’ lakes (Muskoka, Rosseau, Joe) we welcomed just 123 new families in 2022. That’s it. If you wonder why I call this place an anomaly please defer to the precious little inventory!

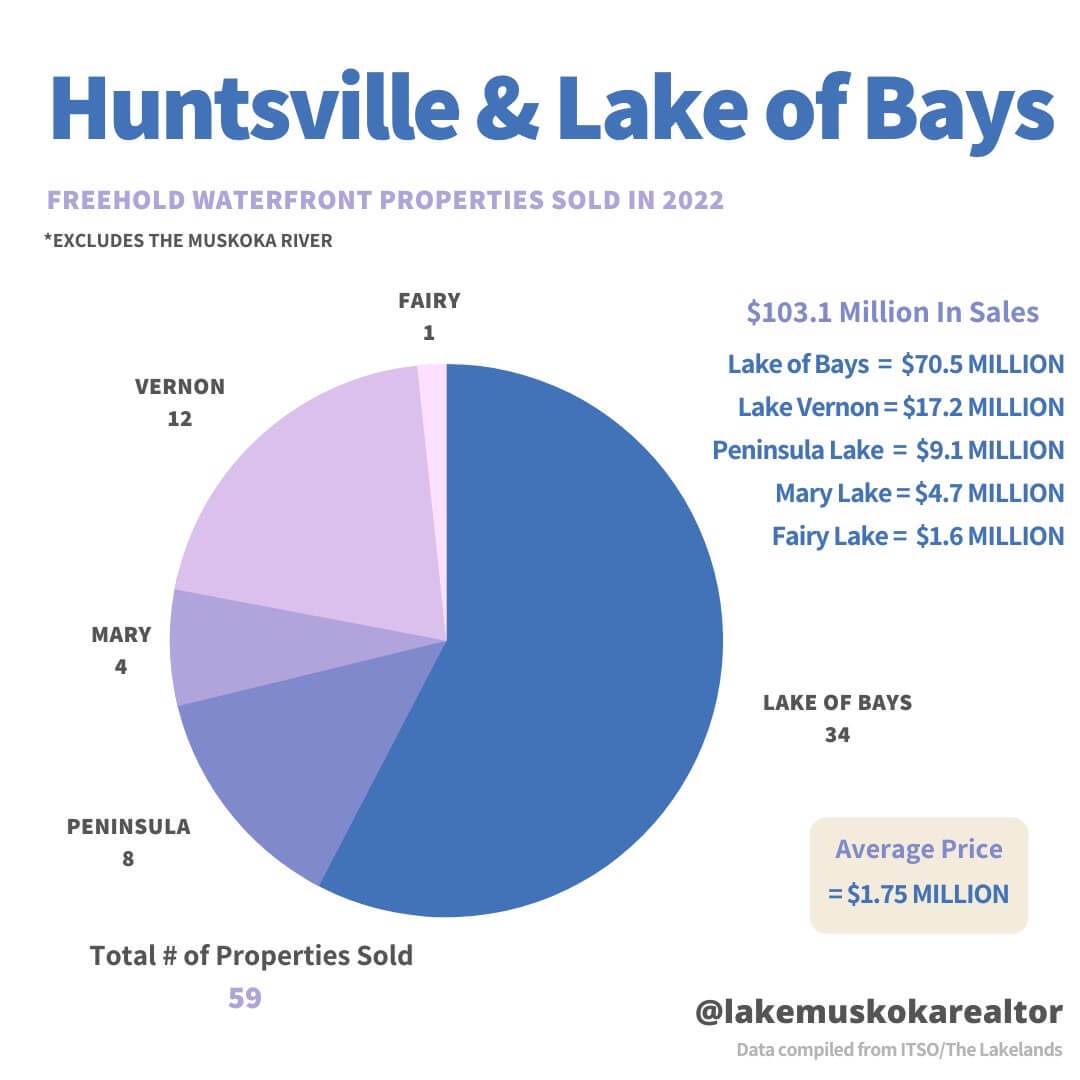

- I’m always fascinated with what’s going on lake by lake and you’ll notice the North, ie Huntsville, has dropped off (queue the reality of traffic/distance from GTA) but there are also major differences between the big 3 too. Know someone who wants to be on mainland on Rosseau? They need to be prepared, as it’s one of the hardest pieces of Muskoka real estate to lock down which naturally means it’s going to cost more.

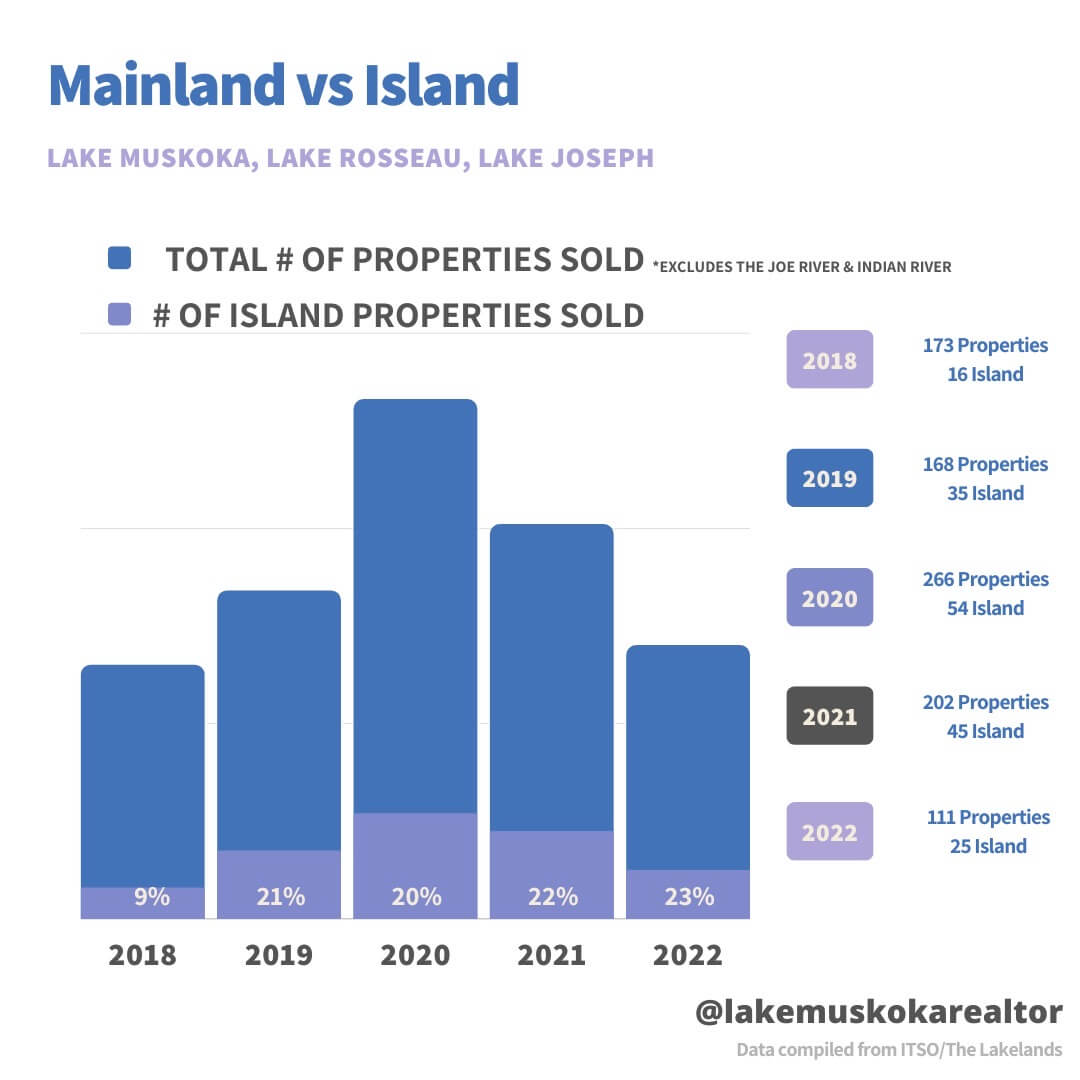

- The fun fact that continues to surprise us 5 years running is the ratio of mainland to island sales on the big 3. Queue the old 80/20 rule … just 20% of the sales on the 3 lakes were on islands. Interesting that that ratio really hasn’t shifted in 5 years, especially with the spike in prices on the mainland during covid. Islands on the big 3 tend to be approximately 60% less expensive than mainland; with limited availability I thought perhaps more folks would learn to drive a boat and deal with the triple lug of everything, but no, I was wrong. Buyer demand for waterfront in Muskoka, let alone the big 3, has gone nowhere, so that tells me there are droves of them sitting on the sidelines holding out, and likely hoping that this will be ‘their Spring’.

- There are a few properties actively for sale, a handful of exclusives kicking about and no shortage of buyers on the sidelines. Interesting to note on the big 3 there was a 56% sell through ratio in 2022 meaning there are 90 odd properties that didn’t sell. Why? The most logical deduction is that many were overpriced as there was still a fair bit of sell side ‘pricing for the stars’. While a few parties may have been testing the waters my guess is that we will see the majority come back on the market as we get closer to the Spring.